Business Week: $1 trillion reconstruction plans, challenges for the economy and investment climate

The Ukrainian government proposes to create two large-scale funds totaling $1 trillion for post-war reconstruction and modernization. Meanwhile, the US company BlackRock Inc. has stopped looking for investors for the multibillion-dollar Ukraine Recovery Fund.

Our country's financial stability has improved, with international reserves reaching $45.07 billion. Ukraine's imports were almost twice as high as exports. The trade deficit increased by one third. Inflation reached its peak this year in May due to higher prices for raw food. However, according to the National Bank, it began to slow down in June .

What are the trends in state assets and the business climate in Ukraine? What are the forecasts for the harvest and renewable energy development? Read in the business news digest LIGA.net for the last week.

Ukraine proposes to create two $1 trillion funds for reconstruction and investment

Ukraine's Cabinet of Ministers has presented the concept of creating two large-scale funds totaling $1 trillion for the country's post-war reconstruction and modernization. According to LIGA.net, this was announced by Prime Minister Denys Shmyhal during a meeting of the Ukrainian Donor Platform for URC-2025.

Photo: Cabinet of Ministers

The first is the $540 billion Ukraine Fund, which, according to Shmyhal, is in line with the World Bank's current assessment of recovery needs. This fund should be administered by Ukraine. The sources of funding are confiscated Russian assets and a special tax on the export of Russian raw materials.

The second is the $460 billion European Structural Fund, which already includes investments by the EU private sector in the development of production in Ukraine. "The projects that will be implemented at the expense of these funds will bring benefits not only to Ukraine, but also to the entire European economy," Shmyhal emphasized .

He also said that Ukraine, together with its partners, has already launched the ERA financial mechanism to use frozen Russian assets, is implementing a program with the IMF and has enough funds to cover the state budget deficit in 2025.

Separately, the prime minister announced a request for funding for 2026-2027, in particular for security needs.

"We offer our European partners to invest in European defense by co-financing the Ukrainian army. Military expenditures now amount to $100-120 billion. In a peaceful environment and without taking into account the production of weapons, the maintenance of the Ukrainian army will cost 50 billion euros a year. We expect that half of this amount will be provided by the EU," the Prime Minister emphasized and added that Ukraine is ready to become a guarantor of European security.

BlackRock stops looking for investors to rebuild Ukraine. The EU will replace it

The world's largest asset management company is no longer looking for funding for Ukraine's recovery. Four EU countries together with the EIB launch investment fund to attract private financing to Ukraine.

Ursula von der Leyen (Photo: EPA/TOLGA AKMEN)

US corporation BlackRock Inc. stopped looking for investors for its multibillion-dollar Ukraine Recovery Fund earlier this year after Donald Trump won the US election. This is reported by LIGA.net with reference to Bloomberg.

The fund was to be presented at the Conference on the Restoration of Ukraine in Rome. According to the sources, the fund has almost received initial support from structures funded by the governments of Germany, Italy and Poland.

However, back in January, BlackRock suspended talks with institutional investors due to a lack of interest and growing uncertainty about Ukraine's future,.

reports

Last year, BlackRock Deputy Chairman Philippe Hildebrand said the fund was to secure at least $500 million from countries, development banks and donors, as well as $2 billion from private investors. The World Bank and other organizations estimate that the total cost of rebuilding Ukraine after a full-scale Russian invasion could exceed $500 billion .

Meanwhile, European Commission President Ursula von der Leyen announced the creation of a European Flagship Fund for Ukraine's Recovery during the Rome Conference on July 10 , which she said would be the largest equity fund in the world dedicated to supporting the country's recovery.

"We are literally betting on Ukraine's future by using public funds to attract large-scale private sector investment and help rebuild the country," von der Leyen said .

The new fund was decided to be created after the American asset management company BlackRock stopped looking for investors to rebuild Ukraine.

Von der Leyen emphasized that Europe remains the largest donor to Ukraine since the full-scale invasion, providing almost 165 billion euros of support. This year, the EU will cover 84% of the external financing needed by Ukraine.

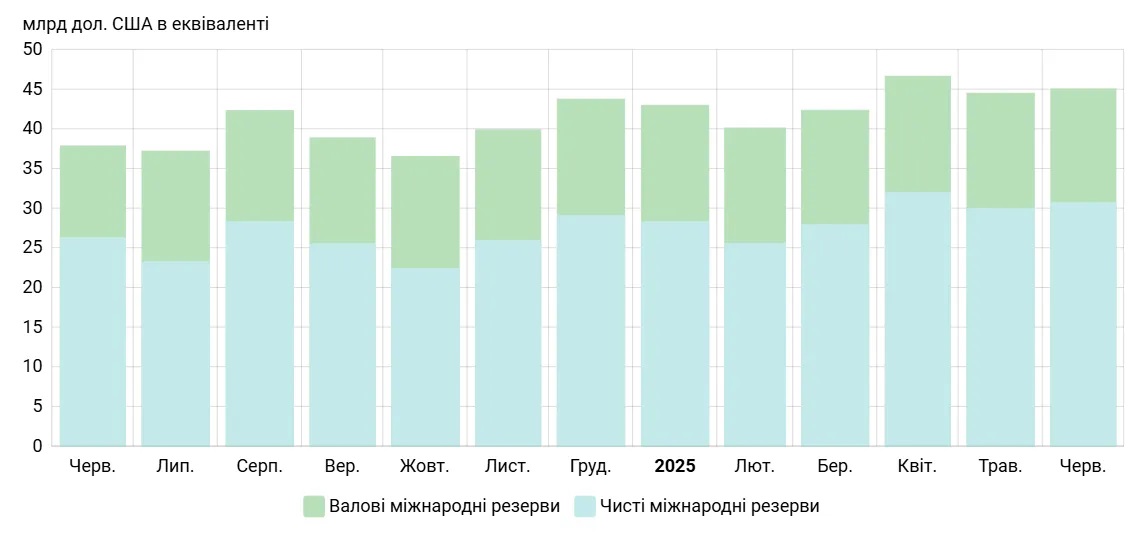

Ukraine's international reserves exceeded $45 billion in June

Financial Assistance from Ukraine's International Partners Exceeds Expenditures on Foreign Exchange Interventions and External Debt Service.

Graphics: NBU

As of July 1, 2025, Ukraine's international reserves increased to $45.07 billion after a decrease in May. The month-on-month increase was more than $500 million, or 1.2%,, reports LIGA.net with reference to website NBU.

The positive dynamics of reserves is driven by significant inflows from international partners, which exceeded the costs of foreign exchange interventions and external debt servicing.

In June, the Ukrainian government's foreign currency accounts received more than $4 billion under the G7 ERA (Extraordinary Revenue Acceleration for Ukraine) initiative: $1.7 billion from the Canadian government, $1.2 billion through World Bank accounts and $1.2 billion from the European Union .

At the same time, Ukraine paid $524 million for servicing its foreign currency debt. Separately, the IMF received $426 million.

In June, the NBU's net foreign exchange sales remained almost unchanged compared to the previous month and amounted to $3 billion.

According to the NBU, the current volume of international reserves provides funding for 5.6 months of future imports, which is sufficient to maintain the stability of Ukraine's foreign exchange market.

- The current level of international reserves is close to the historical high set in April. It is supported by external assistance, which will start to decline in 2026.

- The NBU forecasts about $58 billion in international reserves by the end of 2025.

Ukraine's imports are almost twice as high as exports. The deficit reached $18.3 billion

Ukraine imported $38.3 billion worth of goods in six months, exported only $20 billion.

Photo: Depositphotos.com

Ukraine's trade turnover in the first six months of 2025 amounted to $58.3 billion, reports LIGA.net, citing data from the State Customs Service.

In January-June, imports reached $38.3 billion, while exports totaled $20 billion. The trade deficit compared to the same period of the previous year increased by one third – from $13.7 billion to $18.3 billion.

China ($8.2 billion), Poland ($3.5 billion), and Germany ($3.2 billion) remain the main suppliers of goods to Ukraine, while the main imports are machinery and equipment, chemicals, and fuel and energy products.

Inflation peaked in May. In June, it already started to slow down

In May, inflation peaked this year and, according to the National Bank, returned to decline in June. According to LIGA.net, this is stated in the July Macroeconomic and Monetary Review of the regulator.

Illustrative photo: Depositphotos.com

"In May, consumer inflation accelerated (to 15.9% yoy), exceeding the NBU's forecast due to a higher-than-expected rise in raw food prices," central bank analysts say.

Livestock products (milk, meat, and eggs) and certain vegetables and fruits made the largest contribution to the increase in the consumer price index. These categories were affected by higher production costs, a reduction in livestock numbers, and unfavorable weather.

Core inflation slowed to 12.3%. The NBU attributes this to the previous key policy rate hike and stable energy supply, which reduced underlying price pressures.

The regulator expects further easing of annual inflation in the second half of 2025, provided that the situation with energy supply remains stable and there are no new shocks to the food market.

Inflation expectations of businesses and households "slightly deteriorated," but are still significantly lower than actual price growth.

The NBU will continue to use the key policy rate, foreign exchange interventions, and bank liquidity requirements to keep underlying pressures under control and bring inflation back to its 5% target in the medium term.

- The previous peak of inflation in Ukraine was recorded at the end of 2022 – 26.6%, when the discount rate was 25%.

- It remained at this level until July 2023. Then, due to a significant slowdown in inflation , the NBU began to gradually reduce the rate. Since December 2024, the cycle of rate hikes has resumed .

State-owned banks have stepped up sales of retail loans at auctions

In 2014, only one lot of non-performing loans was sold through SETAM, and in six months of 2025, ten at once.

Photo: Depositphotos.com

In 2025, Ukrainian state-owned banks significantly stepped up sales of non-performing loans to individuals through auctions. The total amount of sold claims amounted to more than UAH 89 million, said Roman Osadchuk, CEO of SE SETAM, in a commentary LIGA.net .

This year, 10 lots with claims under loan agreements with individuals were sold through the state electronic platform OpenMarket (SETAM). These are loans that were recognized as uncollectible and written off due to the provisions made.

The largest share of the sold debts was formed by Ukreximbank – it sold 8 lots for a total of UAH 73.9 million. Ukrgasbank sold 1 lot for UAH 13.7 million, and Oschadbank sold claims on one lot for UAH 1.3 million.

For comparison, in 2024, the market activity was much lower: only one lot was sold through SETAM – the rights to claim on loans to individuals PrivatBank for UAH 13.1 million.

UGA predicts increase in harvest in Ukraine: expects growth due to corn

The Ukrainian Grain Association (UGA) forecasts the harvest of grains and oilseeds in 2025 at 83 million tons. This is 5.5% more than in the previous marketing year, when 78.7 million tons were harvested. This was reported by with link to Interfax-Ukraine.

Photo: EPA

"We forecast an increase in production by 5 million tons. We forecast 83 million tons of grains and oilseeds. We think that the increase will be primarily due to corn. We have very good corn," said Mykola Gorbachev, President of the Ukrainian Grain Association, at a meeting of the Grain Club in Kyiv on Wednesday .

According to him, there are no risks for the development of grains and oilseeds. Unless the harvesting campaign this year is delayed due to cold May. In particular, corn harvesting will start in late September or early October instead of August.

Nevertheless, Gorbachev praised the potential of crops this season.

"We are quite optimistic about yields at the moment. If nothing ultra-catastrophic happens with the weather conditions, we will be able to grow a very good harvest," he said .

According to the head of the industry association, Ukraine can harvest 29.26 million tons (up to 30 million tons under favorable weather conditions) of corn, 22.5 million tons of wheat, about 4.9 million tons of barley, almost 15 million tons of sunflower seeds, and 3 million tons of winter rape.

- The UN believes that Ukraine's wheat harvest in 2025 will be below the average for the last five years.

- The US Department of Agriculture (USDA) has predicted that Ukraine will have the smallest wheat harvest in 13 years .

- The most pessimistic forecast suggests that Ukraine will harvest 10% less grain due to a dry winter and a delay in the sowing season.

Ukraine is building more than 700 MW of new wind farms with 200 MW of energy storage systems

In Ukraine, as of July 2025, more than 700 MW of new wind power plants are under construction with more than 200 MW of energy storage systems. This was reported to by Andriy Konechenkov, Chairman of the Board of the Ukrainian Wind Energy Association (UWEA), at the URC-2025 conference in Rome.

Illustrative photo: Depositphotos.com

According to its data, between 2022 and the first quarter of 2025, 258 MW of new wind capacity was commissioned in Ukraine, 50% of which was financed by international investors.

As of today, the total installed capacity of wind generation in Ukraine is 1.9 GW, with 69% of it located in the temporarily occupied territories.

The most active development of new construction has shifted to the western regions, which are considered relatively safer.

By 2030, according to the National Renewable Energy Action Plan, Ukraine plans to reach 6.2 GW of installed wind power capacity.

Konechenkov also recalled the adopted Strategy for the Development of Distributed Generation, which defines wind energy as a key element in creating a decentralized and sustainable energy system.

A year ago, Ukraine had 58 wind power projects at various stages of development with a total capacity of more than 7 GW.

Enforcement Service writes off UAH 126 million from Energoatom's accounts

Energoatom warns of a threat to energy security due to the State Enforcement Service's forced collection of money from the company's account.

Photo: Energoatom

The State Executive Service has forcibly collected UAH 126 million from Energoatom's accounts. According to LIGA.net, citing the press service of Energoatom, this became possible after the company was excluded from the list of enterprises against which enforcement actions were suspended during martial law.

The company notes that these funds were supposed to be used to repair nuclear power units, which provide about 60% of Ukraine's electricity. The write-off relates to the debt of Zaporizhzhya NPP, which is under Russian occupation and is a force majeure circumstance.

"Further write-offs may lead to a critical financial condition of Energoatom, which threatens timely repairs, stable operation of power units, fulfillment of international contracts and social benefits for more than 30,000 employees," the company said in a statement.

Energoatom calls on the Ministry of Strategic Industries to cancel the order to remove the company from the list of critical infrastructure, restore the moratorium on executive actions regarding its operations and protect the company from financial pressure.

The company reminds that it supplies electricity to the population at the lowest prices under the program of special obligations, and such decisions may negatively affect the country's energy stability on the eve of the heating season.

In February, MPs submitted a statement to the NABU accusing Energoatom of embezzling budget funds. Based on the statement, the NABU opened a case on embezzlement of UAH 430 million for the construction of new nuclear units.

The state received almost a million more from Firtash's regional gas companies

Chornomornaftogaz, which manages shares in 26 gas distribution system operators (the so-called Firtash's oblgases), has transferred more than UAH 934,000 to the state budget. This was reported by with reference to the National Agency for Asset Recovery and Management (ARMA).

Photo: LIGA.net

These are the funds additionally charged by the ARMA order due to violations committed by the asset manager: more than 611,000 UAH in the first half of 2024 and an additional more than 320,000 UAH, the underpayment of which was established as part of the monthly control of asset management.

"The manager has voluntarily fulfilled all financial obligations and transferred an additional amount to the budget," ARMA said .

In 2022, Chornomornaftogaz paid UAH 172 million to the state budget from asset management. In 2023, the amount amounted to more than UAH 500 million .

- In May 2022, the Pechersk District Court of Kyiv seized the corporate rights of 26 operators of gas distribution systems, and they were transferred to the ARMA.

- In September 2022, Naftogaz established Gas Distribution Networks of Ukraine LLC (Gasmerezhi) as the national gas distribution system operator. Subsequently, the arrested gas distribution companies, including those associated with businessman Dmytro Firtash, began to be transferred to Gazmerezhi.

- Two companies are responsible for the regional gas companies that were transferred to the state: chornomornaftogaz manages the assets, while Gazmerezhi coordinates the work, forms a development strategy and obtains licenses.

- The last of the regional gas companies was integrated into Naftogaz Group in December 2023 .

Prosecutor General's Office closes 3756 criminal cases against businesses

The Prosecutor General's Office has closed 3756 criminal proceedings related to business following the audit. This was reported by to LIGA.net with reference to the data of Prosecutor General Ruslan Kravchenko in Facebook .

Photo: Andriy Gudzenko/LIGA.net

"Formally, these proceedings had explanations, but they had not been investigated for years; they did not contain objective data confirming the composition or event of the crime; in the end, they had no judicial perspective," Kravchenko said .

This is almost 19% of the total number of proceedings found during the audit (over 20,000).

Experts were appointed in more than 4,700 proceedings. 120 proceedings have been referred to court. As for the rest of the criminal cases, "work is ongoing".

Kravchenko became Prosecutor General on June 21, 2025. Five days later, he announced the reorganization of the Department of Investment Protection ("did not meet expectations"), and then ordered an analysis of the feasibility of conducting searches in business and ordered an audit of criminal cases related to business.

Comments (0)