Business Week: Electricity price hikes, privatization, and gasoline shortages in Russia

From September 1st, businesses will have to pay even more for electricity. However, the increase in electricity distribution tariffs may help regional power companies repay their 20 billion hryvnia debt to the transmission system operator, NEC "Ukrenergo".

A German company wants to build a 400 MW wind farm in Kyiv region. Meanwhile, the government is seeking an investor for lithium mining and production in Ukraine. At the same time, an existing investor is suing the Ukrainian state over the suspension of gas extraction licenses and is demanding compensation for damages.

Why and how is the gasoline shortage growing in Russia? How much does Ukraine want to earn from the sale of the Odessa Port Plant? What prices did Ukrposhta set for 30,000 sq. m of its real estate? How did the privatization of the Bilhorod-Dnistrovskyi port end? Who bought two Ukrainian cement plants? Read in the business news digest. LIGA.net over the past week.

The National Energy and Mining Regulatory Commission has increased tariffs for regional energy companies for businesses starting September 1

Photo: depositphotos.com

The National Energy and Utilities Regulatory Commission (NERC) increased electricity distribution tariffs for non-household consumers (the electricity tariff for the population is fixed and unchanged) in most regions, effective September 1st. As reports LIGA.net, this decision was made by the members of the commission on meeting session assembly conference gathering on Tuesday.

The tariff amount depends on the company. On average, the increase is 13.5% for the first voltage class and 23% for the second voltage class.

Currently, consumers pay distribution system operators (regional energy companies) tariffs based on two classes:

- first grade – large consumers who are connected to a line with a voltage exceeding 27.5 kV or consume more than 150,000 MWh per month;

- second grade – consumers connected to a line with a voltage of less than 27.5 kV.

Large consumers have lower network losses, so servicing them costs less for the regional power company. A tariff is set for them that is four to six times lower than for the second class.

The tariff increase is due to the need to repay the debt of regional energy companies to the transmission system operator – NEC "Ukrenergo". The total debt of regional energy companies to the transmission system operator amounts to about 20 billion hryvnias.

Member of Parliament Victoria Gryb called the decision painful, but necessary, because without it, the state-owned enterprises will not be able to repay their debts.

"We will not keep these resources; they are not for Ukrenergo. We will give them to other market participants to ensure liquidity," said, in turn, Ivan Yurik, a member of the board of Ukrenergo.

For some companies, such as DTEK Odesa Electric Networks, this will also help to accelerate the restoration of networks after damage caused by enemy attacks.

A German investor plans to build a 400 MW wind farm near Kyiv

Photo: Vadym Tokar

A German investor plans to build a series of wind power plants with a total capacity of 400 MW in the territory of the Makariv community in Kyiv region. How reports LIGA.net, about this said Vadym Tokar, the head of Makariv.

To implement the project, the community signed a memorandum of cooperation with the German company Notus Energy, an investor in renewable energy operating in the international market and "implementing innovative solutions in green energy."

The wind farm is expected to have about 60 turbines and will be one of the largest in the region.

According to Tokar, the project envisages the creation of new jobs, attracting investments in infrastructure development and the generation of "green" energy without harmful emissions.

"In the current conditions of martial law, the issue of energy security is especially important," Tokar emphasized. "The implementation of modern solutions in the field of renewable energy sources will make our community more resilient and independent."

The Cabinet of Ministers decided to attract an investor to the "Dobro" lithium deposit

Photo: Press service of the Office of the President

On Wednesday, August 27, the Cabinet of Ministers decided to announce a tender for concluding a production-sharing agreement for the Dobra lithium deposit in Kirovohrad Oblast. For information LIGA.net, the Prime Minister announced this Yulia Svyrydenko.

"We have made an important decision for the development of the mineral sector and attracting investment to Ukraine. We are launching a competition to conclude a production sharing agreement in Kirovohrad region. The area contains significant reserves of lithium, which is strategically important for energy and technology," the Prime Minister announced following an extraordinary meeting.

The "Dobra" plot/area/section located in the Novoukrainky district of Kirovohrad region, covering an area of 1706.9 hectares near the villages of Novostankuvata and Ternove.

The main mineral resource is lithium ore, with associated tantalum, niobium, rubidium, beryllium, tin, cesium-containing, tungsten and gold ores. The deposit consists of two main zones of ore-bearing pegmatites: Stankuvatska and Nadiya.

Information on explored lithium reserves has until recently been limited and not yet publicly available. Projected resources (P1+P2) exceed 1.2 million tons. In addition to lithium, the ores may contain other valuable metals: tantalum (prospective and projected reserves – 4700 tons), niobium (8200 tons), rubidium (104,000 tons), beryllium (22,000 tons), tin (4400 tons), and cesium (8000 tons).

According to Svyrydenko, the state is looking for an investor who will ensure not only the extraction of lithium, but also the development of value-added production directly in Ukraine.

The next steps are to publish the announcement within two months, allow three months for applications, and determine the winner.

Svyrydenko previously stated that this project may become a debut for the American-Ukrainian Reconstruction Investment Fund, established under the mineral resources agreement.

In February 2023, the Cabinet of Ministers selected 26 plots of land strategic mineral resources to attract investors. The "Dobra" plot was on this list.

A company from the Smart Energy group has initiated international arbitration against Ukraine

Photo: Smart Energy

The oil and gas company Enwell Energy plc from the group Smart Energy filed a lawsuit against Ukraine in international arbitration over a series of actions by Ukrainian authorities that the company believes violated its rights as an investor. As reports LIGA.net, according to a statement on website company.

Enwell Energy plc accuses Ukraine of interfering with the registration of ownership of its subsidiaries and assets, freezing assets, searching offices and production facilities, and most importantly, suspending licenses for gas and condensate production.

In 2023-2024, licenses for the Vasyschivske and Svytsunivsko-Chervonolutske deposits were suspended, and from November 2024, licenses for the Mechedivsko-Holotovshchinske, Svyrydovskeske, and again Vasyschivske deposits were suspended.

The lawsuit was filed under the UK-Ukraine bilateral investment treaty through the International Centre for Settlement of Investment Disputes (ICSID).

"The company has attempted to resolve the dispute with Ukraine peacefully, including through the procedures provided for in the contract, but these efforts have been unsuccessful. In the company's opinion, Ukraine has violated both its obligations under the contract and the company's rights with its actions," the Enwell Energy statement said.

As part of the arbitration proceedings, the company is seeking monetary compensation for damages and losses allegedly caused by the actions of Ukraine, as well as reinstatement of the licenses for the remaining period until their expiration, and compensation for expenses.

- In January 2023, the State Geological Service blocked Smart Energy's gas production licenses due to sanctions against Vadim Novinsky as the beneficial owner of the company, despite the fact that he transferred it to a trust in December 2022.

- In June 2024, the mining licenses were renewed, but in November they were blocked again due to sanctions against its beneficiaries – the managers of the Cypriot trusts Smart Trust and Step Trust.

- From June to November 2024, Smart Energy, which was previously among the top five largest private gas producers in Ukraine, produced 96 million cubic meters of gas and became the only one of the five companies in Smart Holding to make a profit last year.

- Over the three years of the full-scale war, the holding's net income fell from 8 billion hryvnias to 3 billion hryvnias.

A second Russian region has reported a complete lack of gasoline

Photo: depositphotos.com

In the Leninsky District of the Jewish Autonomous Oblast – a remote and sparsely populated region of Russia near the border with China – the sale of gasoline to the population has been stopped due to a severe shortage. As reports LIGA.net, the district head, Valeriy Samkov, stated on Telegram that sales will likely resume next week.

Currently, gasoline is only available for specialized equipment and emergency services.

The regional authorities stated that the shortage was caused by "disruptions in the regularity of supply" and non-compliance with agreements between suppliers and customers.

At the beginning of the week, completely. Gasoline has run out on the Russian-occupied Iturup Island in the Pacific Ocean.

The Russian Far East is a deficit region in terms of gasoline: its production is less than domestic consumption. The region only has two medium-capacity oil refineries.

As LIGA.net previously reported, Ukraine has recently struck at least 10 large oil refineries in Russia. To cover the deficit, the Russian government introduced a measure on August 1st. a complete ban on gasoline exports. However, the additional volumes for the market are approximately 150,000 tons per month too small, in order to correct the situation.

Ukraine will try to sell the Odessa Port-of-Call Plant for 4.5 billion hryvnias

Photo: OPZ

The Cabinet of Ministers decided to sell. Odessa Port Factory at an open electronic auction for 4.5 billion hryvnias (approximately $100 million). As reports LIGA.net, about this announced on Tuesday, Prime Minister Yulia Svyrydenko.

"OPZ is one of the largest chemical complexes in Ukraine. Before the war, it produced ammonia and urea, and exported fertilizers. But since 2022, the main production has been stopped. The plant operated partially – providing oxygen and nitrogen for critical needs, and performing the functions of a port hub. The enterprise must resume full operation. This is only possible through the involvement of a private owner and investment," said Svyrydenko.

Ukraine has been trying to privatize the oil refineries for several years now. In 2009 Nortima, a company affiliated with the PrivatGroup, won the privatization tender for 99.567% of the shares of PJSC "Odessa Port Factory", offering 5 billion hryvnias ($625 million). Besides Nortima, Azot-Servis, affiliated with the Russian company Sibur, and Frunze-Flora, owned by Konstantin Grygoryshyn, also participated. The auction results were annulled due to suspicion of collusion.

In 2012 The then-head of the State Property Fund, Oleksandr Ryabchenko, said that the privatization of OPZ could bring in 5-7 billion hryvnias ($625-875 million) depending on the competitive conditions.

In 2015 One of his successors, Ihor Bilous, said that, according to his estimates, from the sale of OPZ One can expect at least $500 million, while Prime Minister Arseniy Yatsenyuk named the price of $1 billion.

The latest attempt at privatizing OPZ to date was in 2016 – it was put up for sale first for 13.175 billion hryvnias ($530 million), and then for 5.16 billion hryvnias ($200 million). There were no applications to participate in the tender from potential investors, although about 10 potential buyers expressed interest in the enterprise, and four of them even prepared a package of documents.

Interest was reported from Ukrnaftoburivannya (at that time – Igor Kolomoisky and Vitaliy Khomutnyyk), Glenshee Holdings of Oleksandr Yaroslavsky, American IBE Trade of Alex Rovt, and Amjad Investment of Arab Sheikh Suhaib Salim Bahwan.

The State Property Fund explained that the main factor for the lack of bids was the negative price situation in the global markets for mineral fertilizers, the high price of natural gas, the unprofitable activity of the enterprise, and the continued accumulation of debts, in particular to Ostchem Holding.

During Viktor Yanukovych's time in power, Dmytro Firtash's companies were the main gas suppliers to the state-owned Odessa Port-of-Call Plant (OPZ). After the change of power, the businessman lost control of the asset, but continued to influence the balance of power around OPZ. The gas debt of $250 million to Ostchem was one of the obstacles to the plant's privatization in 2016.

On April 4, 2022, the state-owned chemical enterprise Odessa Port Chemical Plant put into storage due to martial law.

Ukrposhta (Ukrainian Post) has put real estate properties across Ukraine up for sale

Photo: Prozorro.Sales

Ukrposhta (Ukrainian Post) since August 25th, more than forty properties across Ukraine have been put up for auction. As. reports LIGA.net, as evidenced by data ProZorro.Sales.

In total, more than 30,000 square meters of non-residential real estate are being offered for sale at auction, with a total value exceeding 333 million hryvnias.

The lots included both individual premises and entire complexes of buildings located in various regions of Ukraine. The most expensive properties were three complexes of buildings in Rivne: on the Railway Square (starting price 26 million UAH), on Vyacheslav Chornovol Street (over 20 million UAH) and on Marka Vovchok Street (over 20 million UAH).

Among the large lots, properties in Ivano-Frankivsk also stand out: a building on Privezalska Street is valued at almost 20 million UAH, and a complex of buildings in Mykytinetsky Lane – at 18.3 million UAH.

The sales geography covers practically the entire country: from the western regions (Zakarpattia, Lviv, Ivano-Frankivsk) to the central and southern regions. The list includes properties in Kharkiv, Kryvyi Rih, Mykolaiv, Kherson, as well as in smaller settlements.

The cheapest property is a part of a building in the village of Zhdieniovo, Zakarpattia Oblast – its starting price is only 408,000 hryvnias for a space of 69.6 sq. m.

- At the time of Ukrposhta's corporatization in 2017 the company's assets amounted to 8.8 billion UAH, of which real estate accounted for 6.3 billion UAH. Former head of the State Property Fund Dmytro Sennychenko (currently a suspect) said that out of 1.25 million square meters, Ukrposhta uses about half for its intended purpose.

- In 2020, Ihor Smilanskyi, CEO of Ukrposhta, stated that Ukrposhta owns over 12,000 properties, with approximately 5,000 of them being directly owned. He confirmed that only half of the properties belonging to the company are used for their intended purpose and generate profit. The rest, according to him, this is ballast.

The Bilhorod-Dnistrovskyi port has officially been transferred to the ownership of the company Prodivusa

Photo: Wikipedia

On Wednesday, August 27, the process of transferring ownership of the single property complex of the state-owned enterprise "Bilhorod-Dnistrovskyi Seaport" to the private company LLC "Top-Offer" was completed. As reports LIGA.net, about this informed Oksana Kiktenko, CEO of the port.

The process lasted more than four years. In March 2020, the State Property Fund decided to privatize the port.

In April 2021, the Ministry of Infrastructure approved the act of acceptance and transfer of the port, after which, in May of the same year, it was officially transferred to the management of the State Property Fund of Ukraine.

The next stage was an auction, which took place in November 2024. The winner was LLC "Top-Offer". In December, the parties signed preliminary purchase and sale agreement, and the main agreement will be on February 27, 2025.

In July 2025, the Antimonopoly Committee approved the agreement. On August 22, the act of acceptance and transfer of the port was signed between the State Property Fund and the new owner.

The final step was the state registration of the property under the name of "Top-Offer" LLC, which took place on August 27, 2025.

LLC "Top-Offer" is owned by former Verkhovna Rada deputy Volodymyr Prodivus.

A new ferry route will connect Ukrainian and Georgian ports

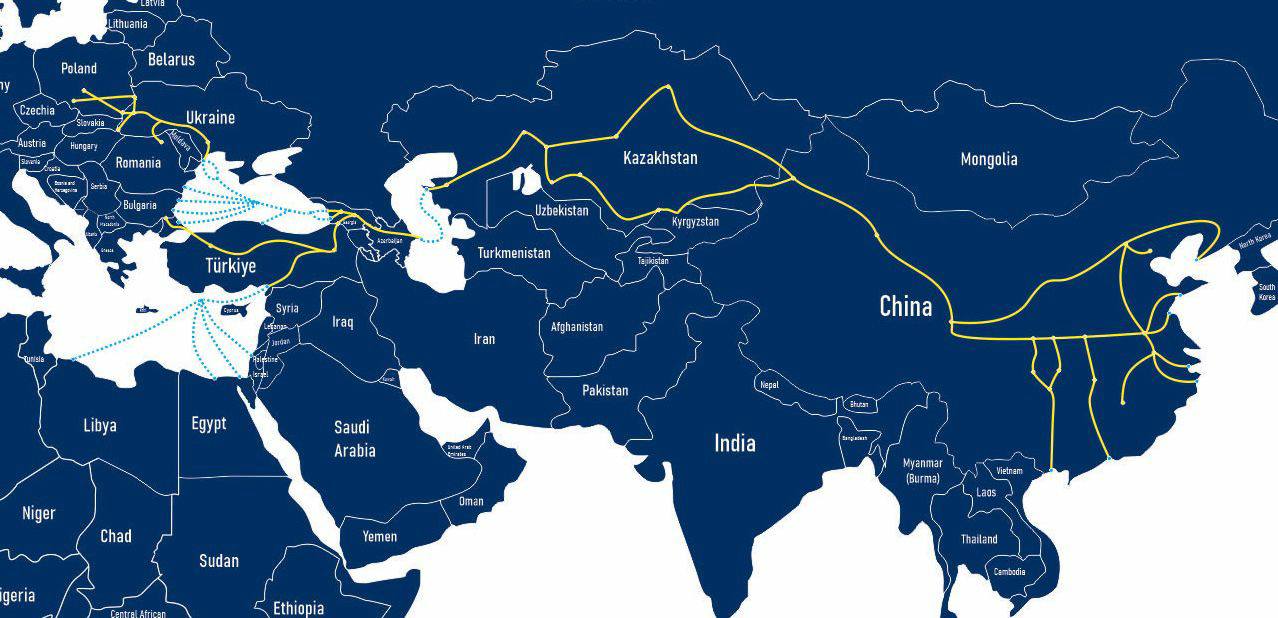

Trans-Caspian International Transport Route. Photo: facebook.com/oksana.kiktenko.2025

The Bilhorod-Dnistrovskyi seaport signed a memorandum with Batumi International Container Terminals LLC (BICT), which manages the container and ferry terminals of the port of Batumi (Georgia). According to information LIGA.net, about this reported Oksana Kiktenko, CEO of the Bilhorod-Dnistrovskyi Port.

This is the second such document aimed at developing the Trans-Caspian International Transport Route (TIR), also known as the "Middle Corridor".

The memorandum provides for the establishment of a new ferry route connecting Ukrainian and Georgian ports.

The construction of a road-rail ferry complex in the port of Bilhorod-Dnistrovskyi is also planned, taking into account the needs of freight flows of the "Middle Corridor".

The purpose of the memorandum is to attract additional volumes of cargo through the "Middle Corridor".

"The port of Bilhorod-Dnistrovskyi plans to become the largest hub for the Silk Road project on the European side of the route," Kiktenko noted.

In June, it was reported that the Bilhorod-Dnistrovskyi seaport signed a memorandum of cooperation with APM Terminals Poti – a subsidiary of Maersk, which owns the largest seaport in Georgia, located in Poti.

Car dealers from Ireland have become co-owners of two cement plants in Ukraine

Photo: depositphotos.com

The Irish company Divinereach Ltd has become a co-owner of the cement plants "Volyn-Cement" (Zdolbuniv) and "Yugcement" (Olshanske) in Ukraine. As reported by LIGA.net, this is stated in a publication by the outlet The Irish Times.

These enterprises are part of PJSC "Vipcem" (formerly PJSC "Dickerhoff Cement Ukraine"), which was sold by the Italian group Buzzi Unicem to the Irish CRH for €100 million in 2024. Under the terms of the Antimonopoly Committee, CRH was obligated to sell 25% of the company's shares to an independent third party within nine months – this is the stake that Divinereach purchased.

The independent shareholder will have veto power over the decisions of the CRH board.

On the website of the Antimonopoly Committee of Ukraine (AMCU) reported, that he approved the Divinereach investment in June 2025.

Divinereach Ltd is a company controlled by the O'Reilly family (owners of the Hyundai distributor in Ireland).

The Irish Times quotes a comment from the Confederation of Builders of Ukraine, which questions Divinereach's qualifications, as the company was only registered in March and has no experience in cement production.

The Ukrainian construction group "Koval'ska" is currently appealing the decision of the Antimonopoly Committee of Ukraine (AMCU), which in 2024 approved the concentration of CRH. It insists that the purchase of two cement plants allowed CRH to concentrate more than 50% of the market in its hands.

General Director of Koval'ska Serhiy Pylypenko in an interview with LIGA.net He said that the AMCU (Antimonopoly Committee of Ukraine) permit was issued with numerous violations. The court of first instance agreed with this, but the appellate court rejected the claim. The Supreme Court should put an end to the dispute in the near future.

CRH entered the Ukrainian market in 1999 with the acquisition of PJSC "Podilsky Cement". In 2011, it bought a controlling stake in LLC "Cement" (Odessa), and in 2013 – PJSC "Mykolaivcement".

Comments (0)